AI Development: The Transatlantic Divide – Europe Playing Catch-Up to US Innovation

Artificial Intelligence has become a critical arena for global competition, with the United States currently in the frontrunner position and Europe striving to catch up. This article compares the top AI companies in the USA and Europe and analyzes the factors that put the US ahead while leaving Europe trailing. It delves into the leading industry players on both sides, examines how regulatory and funding environments differ, considers Europe’s recent investments in AI infrastructure, evaluates the role of China’s rising AI sector (including the much-discussed DeepSeek), and explores policy changes that could help Europe narrow the gap.

The Innovation Gap at a Glance

It is clear that the USA leads in AI development, with Europe falling behind largely due to stricter regulations and less funding. The EU’s AI Act and privacy rules like GDPR appear to be creating significant hurdles for European companies trying to innovate in this space. The funding disparity is particularly striking. While US AI firms consistently secure massive venture capital investments, European counterparts receive substantially less, directly impacting their growth potential. Recent EU investments in data centers might eventually help Europe narrow this gap, but progress remains slow.

One unexpected development is the emergence of China’s DeepSeek, demonstrating that competitive AI models can be developed at lower costs than previously thought, which potentially challenges US dominance.

Comparing the two regions reveals stark differences:

| Metric | USA | Europe |

| Funding (2024) | 49 startups raised over $100M, total $34.7B | Raised €3B, led by France at €1.3B |

| Research Output | Higher patents, 73% of large language models | Lags in patents, fragmented research efforts |

| Market Capitalization | High, e.g., OpenAI at $61.5B post-2025 round | Lower, e.g., Mistral AI valued at €385M |

| Talent Pool | Attracts global talent, higher salaries | Growing, but competes with US for experts |

| Government Support | National AI Initiative, significant R&D funds | EU investments, but less compared to US |

This table highlights the USA’s lead in funding and research, while Europe struggles with regulatory and funding constraints.

Top AI Companies in the USA

The USA’s AI ecosystem is dominated by large tech firms and innovative startups, benefiting from substantial funding and a dynamic market. Key players include:

- Google (Alphabet): Headquartered in Mountain View, California, Google leads AI research through DeepMind and Google Brain, with products like Google Assistant and TensorFlow.

- Microsoft: Microsoft integrates AI through Azure AI services and partnerships with OpenAI, offering tools like Bing AI and Microsoft Copilot.

- Amazon: From Seattle, Amazon leverages AI in Alexa, logistics, and recommendation systems, driving efficiency in e-commerce and customer service.

- Meta: Located in Menlo Park, California, Meta advances AI in social media, with research in natural language processing and computer vision via its FAIR lab.

- OpenAI: San Francisco-based, OpenAI is renowned for ChatGPT and DALL-E, raising significant funds, such as $3.5 billion in a Series E round in March 2025, valuing it at $61.5 billion (TechCrunch).

- NVIDIA: From Santa Clara, California, NVIDIA dominates AI hardware with GPUs and CUDA, essential for AI computations.

- Cursor : Anysphere, the company behind Cursor, was founded in 2022 by four MIT alumni with a mission to build AI systems that enhance developer productivity. Anysphere has raised $68 million in funding, including a $60 million Series A round led by Andreessen Horowitz in 2024, valuing the company at $400 million. Cursor, their AI-powered code editor, is widely used and praised by engineers at leading companies like OpenAI, Shopify, and Instacart for its advanced AI features, such as code generation and smart editing capabilities. Going from $1M ARR to $100M ARR in 12 months, Cursor is the fastest growing SaaS company of all time, growing 9,900% year-over-year.

- Anthropic – Anthropic has emerged as a major player with its flagship AI assistant, Claude. Founded in 2021 by former OpenAI researchers including Dario Amodei and Daniela Amodei, Anthropic was established with a mission to develop reliable, interpretable, and steerable AI systems.

These companies benefit from a robust venture capital environment, with 49 US AI startups raising over $100 million in 2024, and funding rounds often exceeding $1 billion, as seen with Databricks raising $10 billion (Crunchbase).

Top AI Companies in Europe

Europe’s AI landscape includes both research-focused firms and industrial giants, but faces challenges in scaling. Notable companies include:

- DeepMind (UK): Headquartered in London, owned by Google, DeepMind is known for AlphaGo and AlphaFold, contributing to global AI research despite its American ownership.

- Mistral AI (France): Based in Paris, Mistral AI focuses on generative AI, raising €385 million in 2023, aiming to compete with US giants (Tech.eu).

- Aleph Alpha (Germany): From Heidelberg, Aleph Alpha develops large language models, raising over $500 million, and runs the fastest European commercial AI cluster.

- Stability AI (UK): Located in London, Stability AI is known for stable diffusion, an open-source image generation tool, fostering collaboration.

- Faculty AI (UK): Based in London, Faculty AI provides AI consulting, helping businesses integrate AI, with a focus on practical applications.

- Siemens (Germany): Headquartered in Munich, Siemens invests heavily in AI for manufacturing and healthcare, leveraging its industrial expertise.

- Airbus (France): From Toulouse, Airbus uses AI in aircraft design and maintenance, enhancing aviation efficiency.

European AI firms raised nearly €3 billion in 2024, with France leading at over €1.3 billion, but this is dwarfed by US funding levels (Tech.eu).

Reasons for Europe’s Lag

Several factors contribute to Europe’s lag, as identified in recent studies.

The EU AI Act: In 2021, the European Commission proposed the AI Act, which is on track to become the world’s first comprehensive AI law. The AI Act takes a risk-based approach, categorizing AI systems by risk levels (unacceptable risk, high-risk, limited, minimal) and imposing requirements accordingly. While the goal is to ensure AI is “human-centric” and trustworthy, critics argue that the Act’s stringent rules could stifle innovation. The Act will apply broadly to any AI system in the EU market (including non-EU providers) and carries hefty fines for non-compliance (up to €35 million or 7% of global revenue). Its obligations include strict data governance, transparency, and human oversight for high-risk AI.

The challenge is that general-purpose AI models like OpenAI’s GPT-4 or Google’s Gemini don’t fit neatly into this framework – they have countless applications, making it hard to anticipate every risk. One of the Act’s own co-architects admitted the framework “does not suit the complexities” of contemporary AI models. Moreover, vague definitions and multiple overlapping regulatory bodies create legal uncertainties for AI developers

Crucially, the AI Act’s stringent compliance demands (documentation, risk assessment, etc.) could deter companies from pursuing cutting-edge AI research in Europe

By design, high-risk AI applications will face intense scrutiny and compliance hoops. This may lead firms – especially startups and SMEs – to “think twice” before developing advanced AI in Europe. As one analysis warned, such strict regulations risk causing European AI companies to lag further behind their U.S. and Chinese competitors, “where regulation is more lenient.”

In other words, while the U.S. currently has no comparable federal AI law (relying on voluntary guidelines and sectoral rules), Europe’s early move to regulate could backfire if it slows down its own innovators. By focusing on regulation over innovation, Europe indeed “risks dropping back in innovation” as the global AI race accelerates.

- Regulation:

- The EU’s AI Act, effective from August 2024, imposes stringent requirements on high-risk AI systems, including risk management and impact assessments. For instance, a startup offering AI tutoring must set up compliance systems, deterring innovation (The Economist).

- Privacy rules like GDPR add compliance costs, delaying product launches, especially for startups, as seen with German manufacturers hesitant to use proprietary data for AI due to regulatory fears.

- Underfunding:

- European AI firms receive less venture capital, with only 20% of global AI funding in 2024, compared to 50% for US firms (TechCrunch). This limits scaling and R&D, as seen with Mistral AI’s funding being significantly lower than OpenAI’s.

- The EU attracted only 11% of global VC in 2016, highlighting a long-standing funding gap (McKinsey).

- Talent and Research:

- The USA has more top-tier universities like Stanford and MIT, attracting AI talent, with higher salaries making it hard for Europe to compete. Europe’s AI talent base grew to over 120,000 professionals, but still lags in research output (Sifted).

- US firms hold 66% of global AI-related private investment, enhancing their research capabilities (Carnegie Endowment).

- Market Dynamics:

- The US market is larger and more dynamic, fostering a culture of risk-taking, as seen with Silicon Valley’s startup ecosystem. Europe’s fragmented market across countries hinders scale, with companies like Spotify valued at $58.73B compared to Amazon’s $1.32T (EQT Group).

- Government Support:

- The US National AI Initiative, launched in 2020, invests heavily in AI R&D, contrasting with Europe’s slower pace, despite efforts like Horizon Europe funding (European Commission).

New Developments and Opportunities

To close the gap, Europe has recently started investing in the hard infrastructure needed for AI – namely, computing power and data centers. Modern AI, especially deep learning, requires massive computational resources (for training large models) and cloud infrastructure to deploy those models. For years, European AI researchers and startups have complained about the difficulty of accessing affordable, large-scale compute within Europe. In mid-2024, executives of Mistral AI warned of a “lack of data centers and training capacity in Europe” needed to develop and scale AI models

As of 2023, Europe hosted only 18% of global data center capacity (and less than 5% of that was owned by European companies), whereas the U.S. accounted for about 37%

This deficit is worrying, especially as demand for AI computing is projected to grow ~22% annually through 2030

In response, the EU is now launching major initiatives to boost local AI infrastructure. A flagship plan unveiled in early 2025 is to build several AI “gigafactories” – essentially large-scale public data centers for AI. The European Commission announced it is raising $20 billion to construct four such AI gigafactories across the EU

These will be “large public access data centres” specialized for training very large AI models, accessible to companies and researchers who might not afford their own supercomputers. EU officials describe it as enabling “all our scientists and companies – not just the biggest – to develop the most advanced very large models” and to make Europe “an AI continent.”

Reuters.com writes The plan is part of a broader European tech investment drive called InvestAI, a €200 billion program that is Europe’s answer to the U.S.’s massive investments in tech (the U.S., for instance, has a $500 billion AI infrastructure initiative dubbed “Stargate”

Europe’s four AI centers, while huge by its own standards, are still playing catch-up to such moves. Each EU AI gigafactory is envisioned to host 100,000 cutting-edge GPU chips, making them four times larger than Europe’s current biggest supercomputer project (the Jupiter supercomputer in Germany)

Yet even one of these planned AI centers would be smaller than Meta’s aforementioned 1.3M GPU U.S. facility, which shows how individual U.S. firms are investing in AI compute on a scale comparable to or beyond entire EU programs

- EU Investments in Data Centers: The EU is investing in data center infrastructure to support AI, addressing computational needs. For example, Macron’s encouragement of data center investments aims to boost AI capabilities (The Economist).

- Regulatory Adjustments: There is a push for harmonized enforcement and relaxation of rules, potentially easing compliance for startups, as suggested in policy discussions (Brookings).

- Attracting Investment: Efforts to attract more VC, with France and Germany leading, could enhance funding, as seen with 2024’s €3B raise (Tech.eu).

- Collaboration: Increased collaboration, like the European Networks of Excellence in AI, fosters synergy, potentially accelerating development (European Commission).

However, these developments are in early stages, and their impact on closing the gap remains uncertain, given the USA’s entrenched lead.

Interestingly, China’s AI trajectory offers a counterpoint here. The breakthrough of China’s DeepSeek model in late 2024/early 2025 has “raised questions about whether AI models can be trained with less computing power”

DeepSeek reportedly developed a GPT-4-level model at a fraction of the cost – under $6 million – by optimizing resources. Its success suggests that innovative techniques (like model efficiency or better algorithms) could reduce the need for brute-force compute. If true, Europe might not need to outspend the U.S. on hardware; it could compete by being clever with the resources it has. This is one reason some argue Europe should focus investment on applications and specialized AI (where it has domain expertise), rather than trying to replicate the “compute-heavy” approach of the U.S. giants

Nonetheless, having some sovereign compute capacity is considered essential for strategic reasons – Europe learned from past dependencies (like cloud computing and even vaccines) that lacking critical infrastructure can be risky.

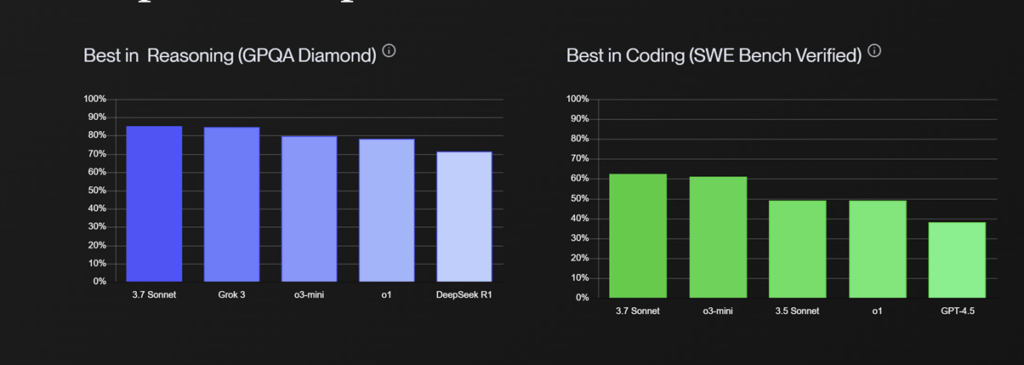

Current large language model benchmarks

Global AI Race

No analysis of AI leadership is complete without considering China, which has positioned itself as a powerhouse in AI research and an emerging force in AI commercialization. China’s AI industry is vast, including tech giants like Baidu (with its Ernie large language model), Alibaba (Tongyi Qianwen model), Tencent, Huawei, SenseTime, and many ambitious startups. While this article focuses on Europe vs USA, China’s progress inevitably affects both: it spurs the U.S. to invest even more heavily (lest it lose its lead), and it puts additional competitive pressure on Europe (which risks falling to a distant third in the AI race).

China’s AI Strengths: China brings a few key advantages to the table:

- A huge talent pool and a fast-growing research output. In terms of sheer volume of AI research publications, China leads the world, surpassing the U.S. and far exceeding Europesciencebusiness.net. Chinese universities and institutions churn out AI PhDs and papers at an impressive rate, and many top Western AI experts are either from China or have collaborations there.

- Government prioritization and funding. The Chinese government has made AI a national priority, aiming to be the global AI leader by 2030. This comes with large-scale state funding, subsidies, and state-guided entrepreneurship. While exact figures vary, an OECD report noted China’s private AI investment at $91B (second only to the U.S.)sciencebusiness.net, and that doesn’t fully capture state investments like research grants or military AI spending.

- Data abundance. China’s massive population and relatively less stringent personal privacy norms (compared to Europe) mean Chinese AI firms have access to enormous datasets – from facial recognition images to e-commerce records – which can fuel AI training. Though China has introduced data privacy laws recently, the enforcement allows more leeway for AI development, especially when aligned with government objectives.

- Integration and deployment. Chinese companies are quick to deploy AI systems across society – from AI-powered superapps (WeChat), to surveillance and smart city systems, to fintech and healthcare AI. This creates a feedback loop of real-world data and iterative improvement.

The mention of DeepSeek is particularly interesting. DeepSeek is a Chinese AI startup (based in Hangzhou) that rose to prominence in late 2024 by releasing a series of advanced large language models (e.g., DeepSeek-R1) with surprisingly strong performance. What stunned observers is that DeepSeek claimed to have achieved this with a relatively small budget (reportedly under $6 million in development cost)

Thanks to efficient engineering and open-source foundations. In early 2025, DeepSeek’s chatbot app even became the most downloaded free app on Apple’s U.S. App Store indicating how quickly a Chinese AI product can catch global attention. DeepSeek’s R1 model, released under an open-license, reportedly offers responses comparable to OpenAI’s GPT-4, despite the startup’s far smaller size

Its success was described as “upending AI”, as it outperformed or matched models from much larger, well-funded U.S. companies

For the U.S., stories like DeepSeek’s are a wake-up call that innovation can arise outside Silicon Valley’s heavy VC machinery. It challenges the assumption that only firms with billions of dollars can build cutting-edge AI. This likely contributed to urgency in U.S. policy circles – for example, motivating projects like the aforementioned $500B Stargate initiative to massively scale up American AI infrastructure

The U.S. is also tightening export controls on AI chips in part to slow China’s progress on training frontier models. The rivalry with China thus pushes the U.S. to double-down on investments, which further widens the gap for Europe if it cannot keep up.

Ad Flare Software OÜ,

VAT: EE102734135

Vana-Viru 13, Estonia, Tallinn

Info